FMFCU’s Digital Banking Guide

Take advantage of many free features included within FMFCU Digital Banking. Learn about Online Banking and Mobile Banking features by category or explore a full list from A-Z. Get started today!

START HERE – Watch How-To Videos:

Explore Top Digital Banking Features by Category:

Send Money

-

-

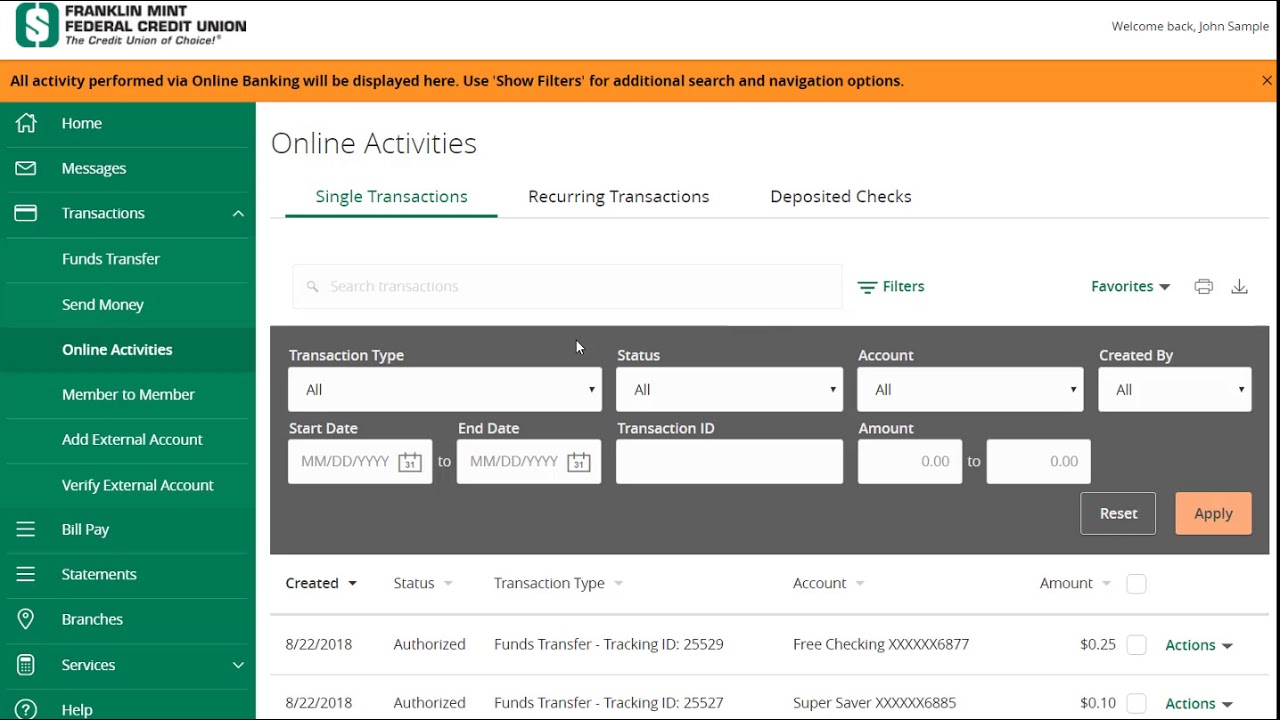

External Account TransferMove money to or from accounts outside FMFCU or make payments by transferring funds to your loan or line of credit accounts. LEARN MORE

-

Funds Transfers (One-Time/Recurring)Move money between your FMFCU accounts. LEARN MORE

-

Member to Member TransfersSend money to any member of FMFCU who has Digital Banking. LEARN MORE

-

ZelleSend money to, and receive money from, people you know and trust who have a bank account in the U.S. LEARN MORE

-

Checks and Payments

-

AnytimeDepositSave time by depositing checks using a mobile device. LEARN MORE

-

Bill PaySchedule and manage bill payments. LEARN MORE

-

Digital WalletsUse a mobile device to make purchases in-store and online. FMFCU supports many digital wallets. LEARN MORE

-

Stop Check PaymentRequest to cancel your check. LEARN MORE

-

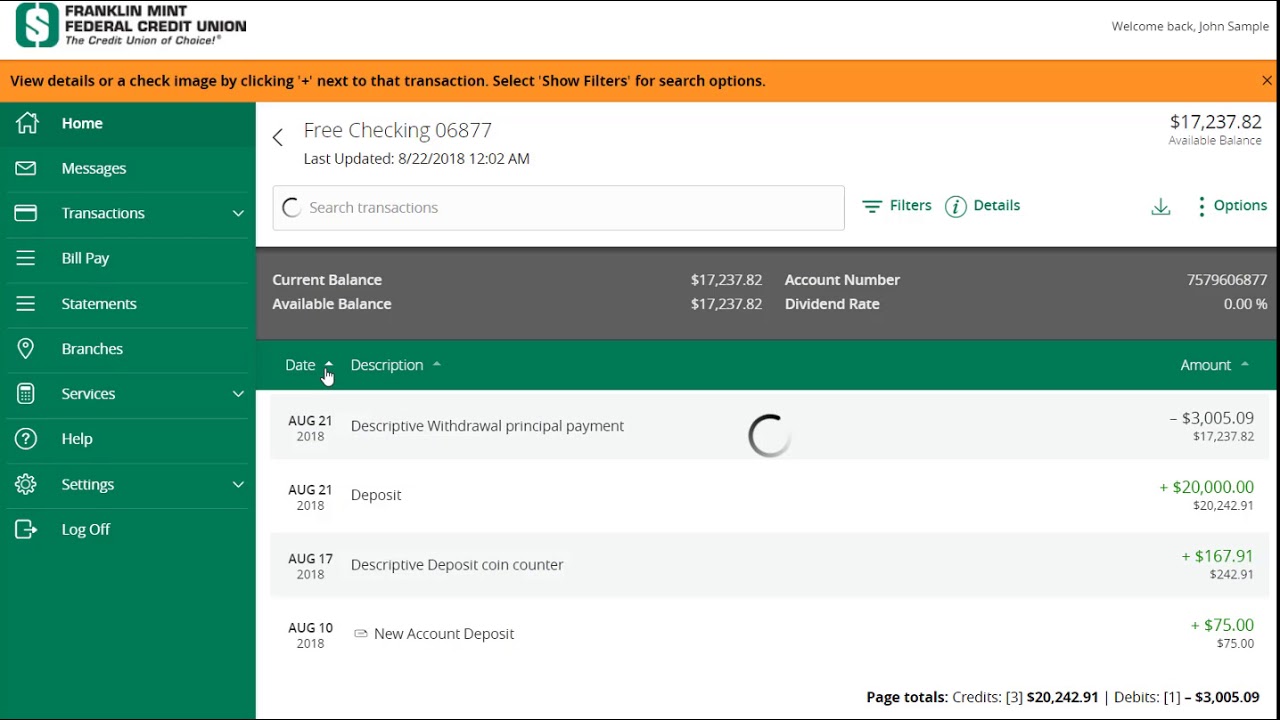

View Check CopiesView deposited checks. LEARN MORE

Security Tools

-

Account Activity AlertsReceive alerts when certain transactions occur. LEARN MORE

-

Digital Banking Security AlertsConfigure custom text alerts and stay aware of account activity. LEARN MORE

-

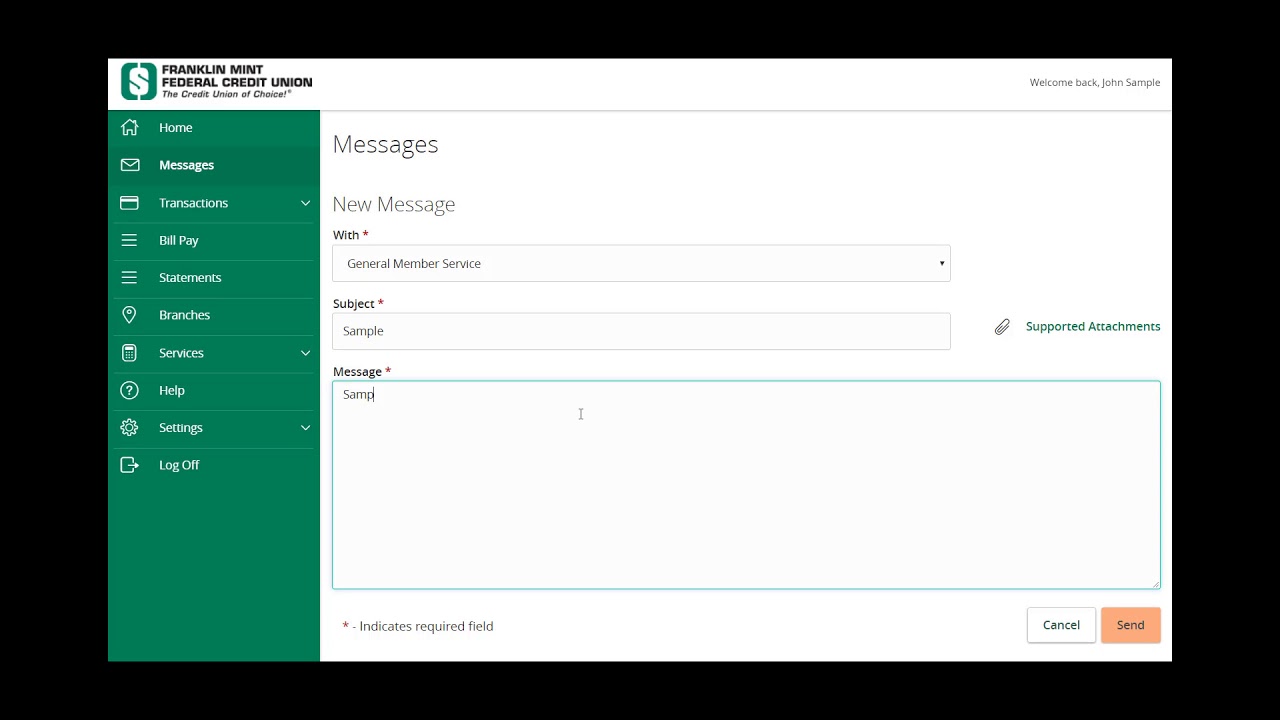

Secure MessagingSend messages containing confidential information to FMFCU’s Member Service Center and receive responses. LEARN MORE

-

Visa Purchase AlertsSet up text alerts for certain transactions on Visa’s network or block online, phone, or foreign purchases with Card Controls. LEARN MORE

-

Visa Fraud Text AlertsGet notified if suspicious activity occurs on an FMFCU Debit Card. LEARN MORE

Personalize

-

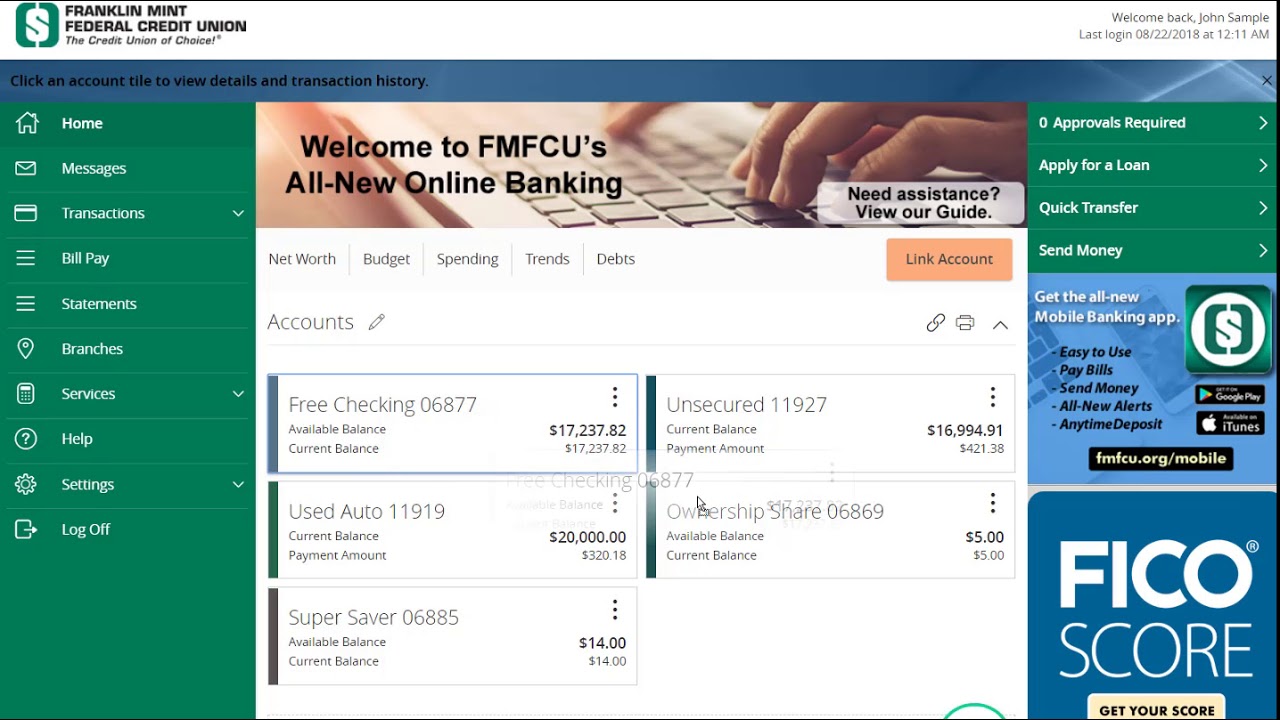

Financial ToolsOrganize your finances and stay on top of expenses with several available tools. LEARN MORE

-

ThemesChange the look and feel inside your Online Banking and Mobile Banking. LEARN MORE

Account Services

-

Account Details & SettingsView information about your deposit and loan accounts such as account number, current balance, payment amount, and more. LEARN MORE

-

Address ChangeRequest an update to your address on file quickly and conveniently in a few steps. LEARN MORE

-

Online StatementsSwitch to Online Statements to view current and past statements online. LEARN MORE

Explore Digital Banking features from A-Z.

Download FMFCU’s Mobile App

Once the app is downloaded, tap “New user” to begin or login with your current Online credentials.

App store is a trademark of Apple Inc., registered in the U.S. and other countries and regions.

Google Play and the Google Play logo are trademarks of Google LLC.