Guaranteed Asset Protection (GAP)

GUARANTEED ASSET PROTECTION

Get essential protection for your vehicle loan—and your finances. Vehicle loan protection for what your auto insurance may not cover for a wrecked vehicle.

That’s where Guaranteed Asset Protection (GAP) comes in.

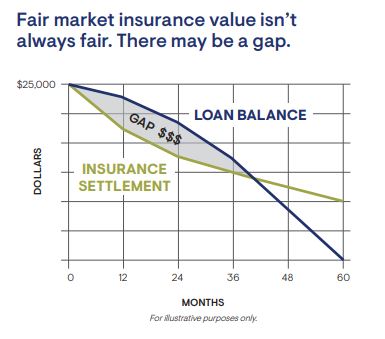

If your vehicle is deemed a total loss due to an accident or stolen, there can be a significant gap between what you owe on your loan and what your auto insurance will cover. GAP may reduce or even eliminate that shortfall in the event your vehicle is deemed a total loss. GAP Plus can help reduce your next loan at the credit union, making it easier to get the replacement vehicle you’ll need.

GAP PLUS helps protect members against financial loss if a GAP-protected vehicle is stolen or declared a total loss, easing the members’ financial burden by waiving the difference between the members’ primary insurance settlement and their vehicle loan balance. GAP Plus also allows $1,000 to be waived from your replacement vehicle when you finance your next loan or lease with FMFCU.

GAP PLUS WITH DEDUCTIBLE ASSISTANCE is an additional benefit for protected vehicles (does not include RVs or Motorcycles). GAP Plus with Deductible Assistance may reduce or even eliminate that shortfall in the event your vehicle is deemed a total loss and may help reduce your next loan at the credit union, making it easier to get the replacement vehicle you’ll need. Also, if auto repairs cost more than your deductible, the deductible amount is applied to your loan, reducing what you owe.

HOW TO GET GAP PLUS OR GAP PLUS WITH DEDUCTIBLE ASSISTANCE, OR FOR MORE INFORMATION:

Visit a branch location or call a Member Relationship Advisor at 610-325-5100 (800-220-3193, Outside PA).

Your purchase of MEMBERS CHOICE™ Guaranteed Asset Protection (GAP) is optional and will not affect your loan application for credit or the terms of any credit agreement you have with us. Certain eligibility requirements, conditions, and exclusions may apply. You will receive the contract before you are required to pay for GAP. You should carefully read the contract for a full explanation of the terms. If you choose GAP, adding the GAP fee to your loan amount will increase the cost of GAP. You may cancel GAP at any time. If you cancel GAP within 90 days you will receive a full refund of any fee paid.

GAP-3415626.1-0121-0423 CUNA Mutual Group ©2021, All Rights Reserved.