Payment Protection

Whether taking a loan to renovate your home or buy a vehicle, it can be a financial gamble because life happens and can cause financial hardship, making it difficult to pay bills. Delinquent payments and defaulted loans can cause the loss of assets, negatively impact a credit rating, or cause financial distress to a family. Adding Payment Protection will give you peace of mind.

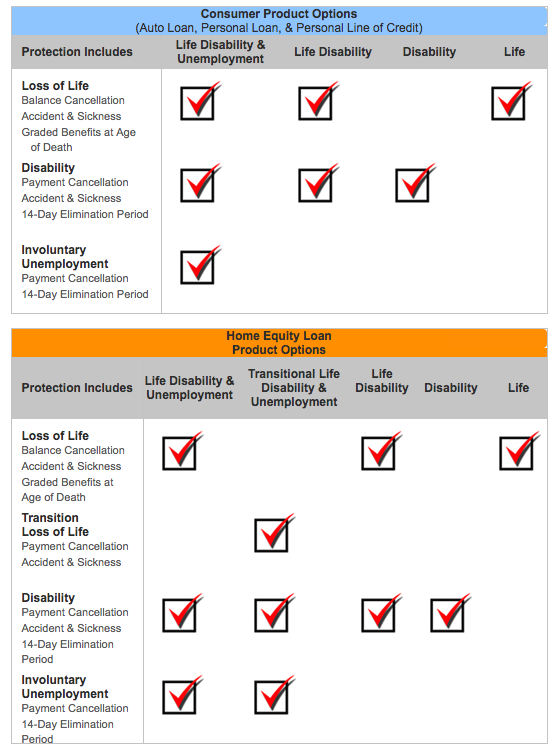

PAYMENT PROTECTION

- Added into monthly loan payment – no extra bill to worry about.

- As loan gets paid down, the monthly cost of Payment Protection is also reduced.

For more information, visit a branch location or call a Member Relationship Advisor at 610-325-5100 (Outside PA: 1-800-220-3193).

*The purchase of Payment Protection is optional and does not affect any application for credit or terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions, and exclusions may apply. Contact a Member Relationship Advisor or refer to Payment Protection contract for full explanation of terms. Payment Protection can be cancelled at any time. If cancelled within first 30 days, a full refund of any fee paid will be issued.