What is Card Skimming?

Card skimming is a method thieves use to collect data from the magnetic strip on a credit or debit card at the time it is being used during a transaction. Skimming involves a device that is illegally installed on machines to store and transfer card data. Card skimming devices are typically installed on the outside of machines and look as if they belong there. This is how thieves make it difficult to spot. Machines most susceptible to skimming devices are gas pumps and ATMs.

Fuel Pump Skimming- Fuel pump skimmers are usually attached in the internal wiring of the machine and are not visible to the customer.

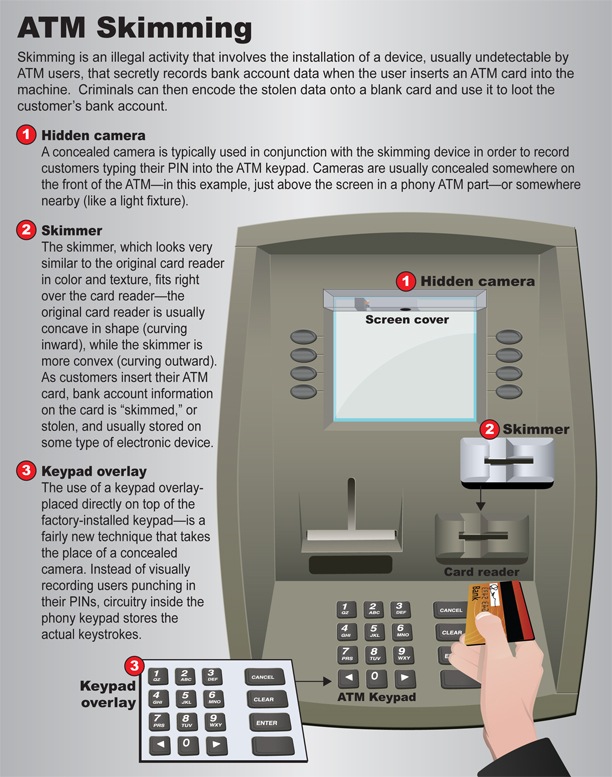

ATM and POS Terminal Skimming- Devices usually fit over the original card reader, but can also be inserted in the card reader, in the terminal or along exposed cables. To collect a pin number, either pinhole cameras are installed to record the number being entered or key overlays are used to record a customer’s keystrokes.

It is estimated that skimming costs financial institutions and consumers more than $1 billion each year.**

Here are Some Tips to Avoid Being Skimmed When Paying With a Card:*

- Do a quick scan. Before using any machine, take a look to make sure it hasn’t been tampered with. Don’t swipe your card if anything looks off. If there is another machine, compare to see if there are obvious differences.

- Be wary of non-bank ATMs. Skimming is more likely to occur at privately-owned ATMs, typically located in convenience stores, restaurants, grocery stores, or bars.

- Check the keypad. If the numbers are hard to press or feel thick, it might have a false keypad installed.

- Block your PIN. FMFCU recommends running a FMFCU debit card as credit. However, if that is not an option for certain cards, when entering your PIN, make sure to cover the keypad with your other hand in case a camera is recording your number.

- Use mobile wallet. As an alternative to swiping your card is paying by mobile wallet, such as Apple Pay, Samsung Pay or Google Pay.

- Pay inside. If a gas station does not accept mobile wallet at their pumps or if you are not sure if the machine is safe to use, pay inside of the service station.

- Stay in public view. Always try to use machines that are in public view with security monitoring, as these are less likely to be tampered with.

- Check your account regularly. Rather than wait for your monthly statement, check your account regularly using FMFCU’s Online and Mobile Banking. This way, if anything were to happen you can catch it immediately.

- Sign up for Fraud Alerts. FMFCU highly recommends members to sign up for VISA Fraud Text Alerts to help monitor your accounts.

- Trust your instincts. If you are in doubt of the authenticity of a machine or suspect foul play, use a different machine or payment method.

If your FMFCU Debit Card has been compromised, contact FMFCU immediately. The card will be deactivated and you will be reissued a new one in the mail.

*Ten Tips to Prevent Card Skimming Fraud, 1st United Credit Union.

**Skimming, Common Scams and Crimes, Scams and Safety, Federal Bureau of Investigation.