The scam is called card cracking* and it may start off innocently enough. You see a post on a social media site announcing a contest. Or maybe a webpage that claims to have a celebrity affiliation is offering a gift card giveaway. The variations are endless, but here’s the tip-off that fraud is afoot. At some point, you’re asked for your bank account information, PIN number, or online banking credential. That’s when you can bank on the fact that those “innocent” offers aren’t what they’re cracked up to be.

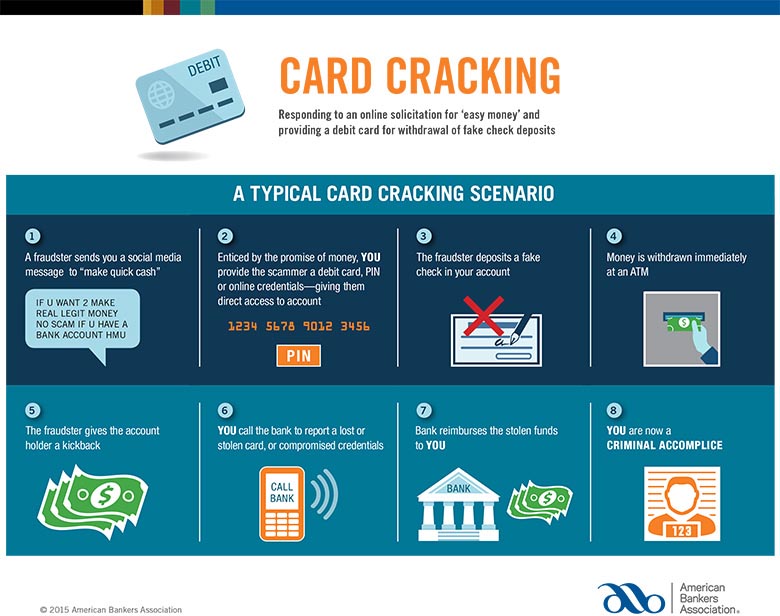

How does the scam work? Once card crackers have access to your account, they deposit multiple checks – usually remotely – and then make quick ATM or money order withdrawals. The goal is to get the cash in hand before the bank figures out the checks are phony.

That form of card cracking works like other scams involving the unauthorized use of your account data. You turn over your information for one purpose only to find out that scammers have used it for their own benefit.

But that’s not the only kind of card cracking. In other variations, people respond to a text, video, or social media post promising fast cash or even explicitly promoting card cracking as an easy way to pay the bills. The account holder – often a student – will hand over their debit card number, PIN, or password and allow checks to be run through their account. In exchange, scammers will offer them a small piece of the action. The account holder may try to rationalize it as just a shady way to game the system, but c’mon. No legitimate business deposits checks that way. What’s really going on is fraud and account holders who cooperate with card crackers have stepped in the middle of it.

The scammers hope the payments are enough to keep the account holder from asking too many questions, but the question people should be asking is whether it’s worth the risk of involving themselves in criminal activity. Thanks to an ongoing card cracking crackdown, suspects are facing indictments, and people who let their accounts be used may be on the hook for the losses.

That’s not the only risk. Scammers have been known to help themselves to funds legitimately in the account – tuition money or a paycheck, perhaps – or to go on a shopping spree with the person’s debit card. If the account holder was in cahoots with the card cracker, it’s tougher to argue that the transactions were entirely unauthorized.

Many students heading off to school or joining the work force are opening their first bank accounts. Involvement in a scam like card cracking threatens their financial future. One tip that bears repeating: No above-board contest, social media promotion, or job opportunity requires that people hand over their bank cards, PIN numbers, or online banking credentials. Never give anyone a crack at your account.

*FTC, “Card cracking: Not what it’s cracked up to be”