Page 5 - 2020 Annual Reprt

P. 5

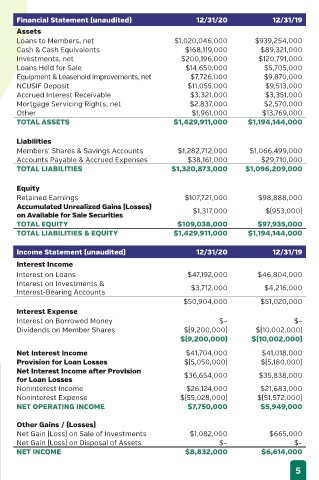

REPORT FROM THE SUPERVISORY COMMITTEE Financial Statement (unaudited) 12/31/20 12/31/19

Assets

For the Credit Union and its members, 2020 proved to be another strong Loans to Members, net $1,020,046,000 $939,254,000

year. FMFCU again achieved consistent growth in key measures of Cash & Cash Equivalents $168,119,000 $89,321,000

performance, including loans, membership, and deposits. As a not-for- Investments, net $200,196,000 $120,791,000

profit, mutually-owned cooperative, FMFCU continues to attract members Loans Held for Sale $14,650,000 $5,705,000

who seek a safe, convenient place to both save money and get loans Equipment & Leasehold Improvements, net $7,726,000 $9,870,000

at reasonable rates. NCUSIF Deposit $11,055,000 $9,513,000

Accrued Interest Receivable $3,321,000 $3,351,000

2020 Highlights Mortgage Servicing Rights, net $2,837,000 $2,570,000

In 2020, total assets reached more than $1.4 billion, rising an astounding Other $1,961,000 $13,769,000

19.7 percent from the prior year. Membership deposits were up 20.3 TOTAL ASSETS $1,429,911,000 $1,194,144,000

percent to $1.28 billion, attributable, in part, to recent economic conditions

resulting from the COVID-19 pandemic. Total membership grew to 116,000 Liabilities

at year end. Loans to members rose 8.6 percent to more than $1.02 billion. Members’ Shares & Savings Accounts $1,282,712,000 $1,066,499,000

Net income at $8.8 million shows a strong increase of 33.5 percent, up Accounts Payable & Accrued Expenses $38,161,000 $29,710,000

from $6.6 million the prior year, allowing FMFCU to continue investing in TOTAL LIABILITIES $1,320,873,000 $1,096,209,000

improving the member experience.

Equity

The Supervisory Committee, as part of its responsibilities, engaged the Retained Earnings $107,721,000 $98,888,000

public accounting firm of RKL LLP to perform an audit as of December 31, Accumulated Unrealized Gains (Losses) $1,317,000 $(953,000)

2020. An unmodified opinion was issued, meaning the statements were on Available for Sale Securities

found to be sound and free from material misstatements. TOTAL EQUITY $109,038,000 $97,935,000

TOTAL LIABILITIES & EQUITY $1,429,911,000 $1,194,144,000

FMFCU Internal Auditors and Federal Regulators from the National

Credit Union Administration (NCUA) also performed annual audits and Income Statement (unaudited) 12/31/20 12/31/19

examinations. Collectively, these evaluations ensure FMFCU maintains the Interest Income

highest standards of accuracy in financial record keeping and reporting. Interest on Loans $47,192,000 $46,804,000

Interest on Investments &

As always, FMFCU appreciates the continued support of its members, Interest-Bearing Accounts $3,712,000 $4,216,000

business partners, and the communities it serves. $50,904,000 $51,020,000

Interest Expense

Interest on Borrowed Money $– $–

Dividends on Member Shares $(9,200,000) $(10,002,000)

$(9,200,000) $(10,002,000)

Net Interest Income $41,704,000 $41,018,000

Provision for Loan Losses $(5,050,000) $(5,180,000)

Net Interest Income after Provision $36,654,000 $35,838,000

for Loan Losses

Noninterest Income $26,124,000 $21,683,000

SUPERVISORY COMMITTEE Noninterest Expense $(55,028,000) $(51,572,000)

NET OPERATING INCOME $7,750,000 $5,949,000

John J. Sullivan, CPA, Chairman Other Gains / (Losses)

FMFCU INTRODUCED Brian Feldman, CPA Net Gain (Loss) on Sale of Investments $1,082,000 $665,000

AN ALL-NEW SECURITY Patrick McKenna, Esq. Net Gain (Loss) on Disposal of Assets $– $–

CENTER ON FMFCU.ORG. Donald Mooney NET INCOME $8,832,000 $6,614,000

Douglas A. Pacitti, CPA

4 5