Page 5 - 2024 Annual Report

P. 5

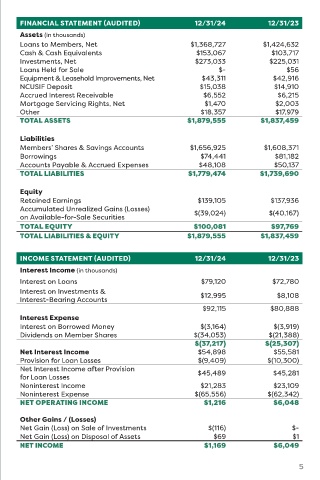

FINANCIAL STATEMENT (AUDITED) 12/31/24 12/31/23

Assets (in thousands)

REPORT FROM THE Loans to Members, Net $1,368,727 $1,424,632

$153,067

$103,717

Cash & Cash Equivalents

SUPERVISORY COMMITTEE Investments, Net $273,033 $225,031

$56

$-

Loans Held for Sale

Equipment & Leasehold Improvements, Net $43,311 $42,916

NCUSIF Deposit $15,038 $14,910

Accrued Interest Receivable $6,552 $6,215

Mortgage Servicing Rights, Net $1,470 $2,003

Other $18,357 $17,979

For the Credit Union and its delinquencies. FMFCU continues to TOTAL ASSETS $1,879,555 $1,837,459

members, 2024 proved to be make investments to improve the

another good year. FMFCU again member experience through delivery Liabilities

achieved consistent growth in key systems, enhanced products, and Members’ Shares & Savings Accounts $1,656,925 $1,608,371

$74,441

$81,182

measures of performance, including new services. Borrowings $48,108 $50,137

Accounts Payable & Accrued Expenses

membership, deposits, and most TOTAL LIABILITIES $1,779,474 $1,739,690

loan portfolios. As a not-for-profit, The Supervisory Committee, as

mutually owned cooperative, FMFCU part of its responsibilities, engaged Equity

continues to attract members who the public accounting firm of S.R. Retained Earnings $139,105 $137,936

seek a safe, convenient place to Snodgrass, P.C., to perform an Accumulated Unrealized Gains (Losses) $(39,024) $(40,167)

on Available-for-Sale Securities

both save money and get loans at audit as of December 31, 2024. An TOTAL EQUITY $100,081 $97,769

reasonable rates. unmodified opinion was issued, TOTAL LIABILITIES & EQUITY $1,879,555 $1,837,459

meaning the statements were

2024 HIGHLIGHTS found to be sound and free from

In 2024, total assets reached material misstatements. INCOME STATEMENT (AUDITED) 12/31/24 12/31/23

$1.88 billion, rising 2.3 percent Interest Income (in thousands)

from the prior year. Deposits were FMFCU internal auditors and Interest on Loans $79,120 $72,780

up 3.0 percent to $1.657 billion. Total federal regulators from the National Interest on Investments & $12,995 $8,108

membership ended at 147,000. Credit Union Administration (NCUA) Interest-Bearing Accounts

Loans to members declined 3.9 also performed annual audits Interest Expense $92,115 $80,888

percent to $1.37 billion, due in part and examinations. Collectively, Interest on Borrowed Money $(3,164) $(3,919)

to the sale of indirect loans to these evaluations ensure FMFCU Dividends on Member Shares $(34,053) $(21,388)

improve overall performance and maintains the highest standards $(37,217) $(25,307)

strenghten liquidity. Net income at of accuracy in financial record- Net Interest Income $54,898 $55,581

$1.169 million shows stable margins, keeping and reporting. Provision for Loan Losses $(9,409) $(10,300)

Net Interest Income after Provision

but stubborn credit losses exist in As always, FMFCU appreciates the for Loan Losses $45,489 $45,281

the loan portfolio. The decline in continued support of its members, Noninterest Income $21,283 $23,109

earnings is the result of funding business partners, and the Noninterest Expense $(65,556) $(62,342)

the allowance for loan loss from communities it serves. NET OPERATING INCOME $1,216 $6,048

heightened loan charge-offs and Other Gains / (Losses)

Net Gain (Loss) on Sale of Investments $(116) $-

Net Gain (Loss) on Disposal of Assets $69 $1

NET INCOME $1,169 $6,049

4 | 2024 ANNUAL REPORT 5